That's what happens with us salary types sometimes. Gotta punch the clock so you can bring home the Benjamins and, more importantly, pay the taxes without which everyone would get sick and die, starve and die, not have roads and die, or just generally freak the fuck out and die.

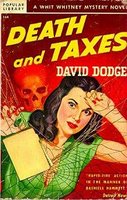

That's what happens with us salary types sometimes. Gotta punch the clock so you can bring home the Benjamins and, more importantly, pay the taxes without which everyone would get sick and die, starve and die, not have roads and die, or just generally freak the fuck out and die.Ah, yes. That's what it was. I wanted to keyboard something about taxes. It was around April 15, Tax Day ... or as I call it, Pull Down My Pants and Slide On The Ice Day.

At the time there was a pretty concerted pro-tax increase public relations effort put forth by... well, who knows but the source was probably somewhere deep in the bowls of our bloated federal bureaucracy. Even a media avoider like me couldn't dodge the bevy of stories featuring "rich" people who want to pay more taxes. I first heard the NPR version of the story, but it was also pretty common in print and on blogs.

And I take the stories at face value. I mean, if the Washington Post reports …

"I'm in favor of higher taxes on people like me," declared Eric Schoenberg, who is sitting on an investment banking fortune. He complained about "my absurdly low tax rates."… I'll take their word that this guy Schoenberg exists and that he wants to pay more taxes. According to the reporting, he's not alone.

But there's something fishy about such a sentiment. For one thing, what people like Schoenberg are saying (if they actually exist) is that they want the government to raise taxes on other people. This is a pretty common liberal viewpoint. And by liberal, I mean the current Democrats and Republicans who seem to think we can continue buying everything for everybody without having to eventually pay for it.

That's all well and good. I've pretty much started to come to grips with the fact that the battle is over and the forces of fiscal restraint have lost. Americans (those who bother to pay attention anymore) have discovered that it's easier to vote themselves other people's money and outsource their social responsibility for their neighbors to the government.

I just find it a bit silly that they feel like they have to wage a PR war to assuage their guilt. They're trying to convince me that raising taxes will be a good thing. That even the rich people want their taxes raised because they want to pay more taxes. Okay. Fine. Let the good times roll.

But here's the thing. If rich people want to pay more in taxes, they can.

Now. Without any acts of congress or anything. If you're a rich bastard, you don't have to shelter all of your earnings. You don't have to hide your assets. You don't have to take the millions of deductions on your tax return.

Now. Without any acts of congress or anything. If you're a rich bastard, you don't have to shelter all of your earnings. You don't have to hide your assets. You don't have to take the millions of deductions on your tax return.Hell, I bet you could even write out a check for $50,000, take it to your local IRS office and just plain donate it to your government that is cash strapped because of its investments in General Motors and insane foreign wars. You'd probably even get a tax deduction for your donation.

So yeah rich people. If you're feeling guilty about not paying enough taxes, then by all means pay more. Just don't expect me to buy in to the BS that I'm getting a good value for my tax dollar.

tagged: Rich, income tax, policy, General Motors, government, Bill Gates, Warren Buffett